|

Tuesday 9th September 2003 |

Text too small? |

That's come in a speech to the Property Council of New Zealand, delivered in Auckland today. An extract from that speech follows.

I'd like now to consider in more detail the New Zealand housing market, it being one of the factors behind our strong domestic economy, at a time when many exporters have seen their incomes retreat in recent months.

New Zealand's housing sector has experienced a strong cyclical upswing over the past 18 months. It's not just Auckland. Sales growth and rising house prices are prevalent in many parts of New Zealand. Building consents are at cyclically high levels. That's both including and excluding apartments.

Residential investment is expanding the nation's housing stock rapidly, yet demand continues to outstrip supply. We see this in rising prices and a shortage of properties listed for sale. The median time it takes to sell a house currently sits at an unprecedented low of just 26 days. As a consequence, recently house prices have been rising rapidly.

What's driving this? The answer is demand exceeds supply. Demographics are part of the story. New Zealand has had rapid population growth in recent years, driven by net immigration. This includes not just people coming here but people here choosing not to leave. The longstanding drift of New Zealanders north and into town is also a factor. In addition, social changes are seeing the average number of persons per home reduce. Life-style changes are increasing demand for new kinds of accommodation, such as inner-city apartments and coastal and lakeside properties.

Some of these factors have been at work for a long time. Even in the late 1990s, when population growth was relatively weak, there was substantial construction activity. However, more recently population growth has been marked. The natural increase in population currently is slower than a decade ago, but recent immigration has been very strong. In terms of permanent and long-term migration we had a net outflow of 10,000 persons per year in early 2001 and a net inflow of more than 40,000 per year in mid-2003. That too undersells the story. In addition we have short-term stays, such as students and those on work permits, and those who apply for residency once they are here. Total migration has been running at more than 60,000 persons per annum over the past two years. This is well in excess of the mid-1990s. Of course, more people means more demand for accommodation.

Is there more to this story? Yes, we think so. In part the demand for housing reflects the fact that people with savings to invest have become disenchanted with the share market and other financial instruments. Savers still remember the 1987 share market crash and more recent tumbles in the US and Europe. As well, savers have seen global interest rates fall to historic lows and headlines of pension funds losing money. At the same time property markets have stayed uncharacteristically buoyant and so there's been a flight to "bricks and mortar".

The proportion of the housing stock owned as rental property has been rising over recent years. Increasing numbers of people prefer to hold wealth in housing assets, as opposed to other investments. Property investment has been rising over the past year.

Of course this isn't all bad. If lifestyles are changing and housing needs are changing and if aggregate demand is up because more people live here, then we want more house construction. If supply meets demand without bottlenecks that's good.

There are, however, some initial signs that housing market activity and expectations of future activity are starting to exceed demand as indicated by demographic fundamentals. Credit demand has accelerated over the last year. Borrowing has begun to accelerate. Debt-to-income ratios, which began to level out in the late 1990s, are starting to rise again.

People working in real estate and financial planning indicate a marked increase in the numbers of would-be investors. The newspapers are running advertisements for seminars offering to coach people on how to invest in property, often promising significant returns.

I am concerned, as I said at the release of the Reserve Bank's Monetary Policy Statement last week, that this could end in disappointment, especially for unsophisticated investors who are rushing to get on the housing-investment bandwagon.

My worry is what if things reverse and supply exceeds demand? What if recent buyers, heavily in debt, find that rents have fallen, making outgoings more than incomings? What if they decide to exit property and then can't sell at prices paid a few months earlier?

How could supply exceed demand? We think that net immigration is likely to ease a little over the next two years. Partly that will reflect Government policy. Also the number of New Zealanders who want to begin their OE may go up again, as the economies of other advanced countries do better relative to ours.

As other investments like equities regain their gloss the person who has bought a house to sell it to another buyer may find that the next prospective buyer has put his or her money elsewhere. When pension funds prosper again, that too will have the same effect.

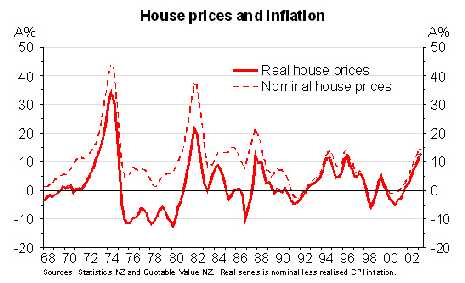

To those who say "Hold on, nothing is as safe as houses," I would say separate nominal from real house prices. Real house prices are what matters. In our recent past there have been extended periods where real house prices have dropped, as illustrated.

In the past price falls were often concealed by high inflation. Also, as the graph confirms, when property prices really skyrocket real property-price deflation often follows soon after. Rising house prices and, by inference, increasing rentals are by no means a certainty. As some New Zealanders found in the 1970s, the late 1980s and to a lesser degree in the late 1990s house prices can fall in real terms.

Other countries, such as the UK, have experienced even more pronounced weakness in their housing markets at stages over the last 20 years. Prudent property investors need to ensure their ability to withstand falling prices and rents at some time in the future.

People thinking of borrowing to buy a rental property should also factor monetary policy into their calculations. If inflation starts to gain momentum in New Zealand, interest rates, nominal and real, will have to be higher to keep that inflation in check. Prospective buyers should ask "Could my gearing face that - would I stay above water come higher interest rates?"

To conclude, why as a central banker should I care about any of this? The narrow answer is that a stretched housing market contributes to inflation. However, the wider answer is that the stability of the New Zealand economy and the security of New Zealand households are linked in terms of risk concentration. For the wider economic interest and for New Zealand households, spreading risk needs to be a higher priority.

No comments yet

Genesis Power cranks out bumper profit

US visitor numbers leap 38% in January

Tourism ratings get megabuck boost

Business watchdog ready for busy year

Minimal debt impact from airline recap

Export prices weather uncertainty

Figures show tourism was booming

Court clears path for Commerce Commission

Close watch on hydro lakes

State-owned powercos not for sale