|

Tuesday 15th May 2018 |

Text too small? |

Apple shares have risen to record levels recently following a quarterly report that topped expectations and news that Warren Buffett’s Berkshire Hathaway has gobbled up more shares. iPhone unit sales were slightly shy of expectations but solid enough and the higher average sales price resulted in a year-on-year double-digit revenue increase from the product. Apple gave shareholders a treat in the form of a dividend hike and expansion of the share repurchase program.

Impressively, Apple’s paid subscriptions increased by approximately 100 million year-on-year to over 270 million by the end of the March 2018 quarter. An increase in this sort of ‘sticky’ revenue could see a higher multiple ascribed by investors going forward.

Even after recent appreciation, Apple shares trade on undemanding multiples of 16 times projected FY18 earnings, falling to 14 times the following year. Given a huge and growing installed base, strong consumer loyalty and the fast-growing ‘services’ business, the case for Apple continues to look tasty in our view.

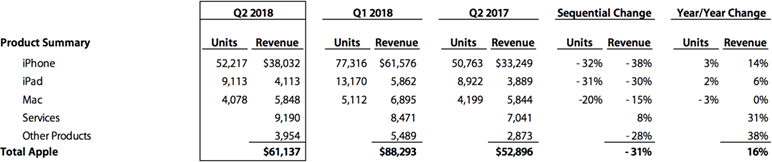

Second quarter revenue increased (for the sixth quarter in a row) to an impressive 16% year-on-year to $61.1 billion, supported by sales of the high-priced iPhone X. Emerging markets along with Japan notched up 20% revenue growth while the Americas wasn’t far behind.

Guidance was more upbeat than expected with revenue for the current quarter forecast in a range of $51.5 billion to $53.5 billion and a gross margin of 38.0 – 38.5%.

It was notable that despite news reports citing softness in iPhone X sales, the model sold more than any other iPhone each week in the March quarter. We have heard the “death of the iPhone” call many times before, but iPhone sales continue to be strong, with customers inherently loyal, and still a somewhat aspirational product for those yet to buy their first one.

Apple sold 52.2 million iPhone units in the quarter, up a modest 3% year-on-year, but a higher average iPhone sales price (due to new models) translated into a 14% year on year increase in iPhone revenues to $38.03 billion.

The services business (containing the App Store, iTunes, Apple Music, licensing, Apple Pay and iCloud) had another cracking good quarter, fuelled by the company’s huge and growing installed base (over 1.3 billion). Revenues of $9.2 billion were a record, surging 31% year-on-year.

Source: Apple

Other products (Apple TV, Apple Watch, Beats products, the iPod, Apple-branded and third-party accessories) while smaller, was a standout performer from a growth perspective, with revenue jumping 38% to $3.95 billion.

The operating margin was down slightly to 26%, but net income surged 25.3% and earnings per diluted share grew 30% year-on-year, with the difference underpinned by share buybacks. Apple returned roughly $26.7 billion to shareholders in the quarter, yet still held a net cash position of $145 billion at quarter end. The board has also issued a new $100 billion share repurchase program.

Apple also hiked the quarterly dividend once again, upping it by 16% to $0.73. No wonder the cash rich company continues to whet the appetite of Warren Buffet, whose investment vehicle has bought another 75 million shares per a recent filing. This move has also played a part in restoring confidence that is helping to turn the broader market around.

Warren Buffett’s comments to reporters that Berkshire would “love to own 100%” of Apple haven’t hurt either. Even for elephant hunter Mr Buffett that is going be tough though, with Apple closing in on a $1 trillion market capitalisation. No problem for others wanting a slice though.

Interests associated with Fat Prophets declare a holding in Apple.

Greg Smith is the Head of Research at investment research and funds management house Fat Prophets.

To receive a recent Fat Prophets Report, call 0800 438 328 or CLICK HERE.

No comments yet

The latest results season has proven better-than-feared on both sides of the Tasman

New Article is coming soon!

Hardening up - James Hardie

Decmil Group - The Ducks are lining up

Spark New Zealand: Taking Something Off The Table

Vocus Communications

Amcor

Apple

QBE Insurance

Hot stock - Domain Holdings Australia