By Anthony Quirk

|

Friday 9th December 2005 |

Text too small? |

|

Year to Date Returns to 30/11/05 |

|

|

|

Sector |

11 month return^ |

Index |

|

Global Property* |

+17.8% |

UBS Global Real Estate Total Return |

|

Global Shares* |

+17.6% |

MSCI World (net dividends reinvested) |

|

Global Shares** |

+10.1% |

MSCI World (net dividends reinvested) |

|

Hedge Funds* |

+10.9% |

Tyndall’s Fund of Funds Manager |

|

NZ Shares |

+8.2% |

NZX50 |

|

Global Bonds* |

+7.0% |

Lehman Brothers Global Aggregate |

|

Cash |

+6.5% |

NZX 90 day Bank Bill |

|

NZ Bonds |

+5.7% |

NZX Government Stock |

|

^to 30/11/05 and before tax and fees, *fully hedged, **unhedged |

||

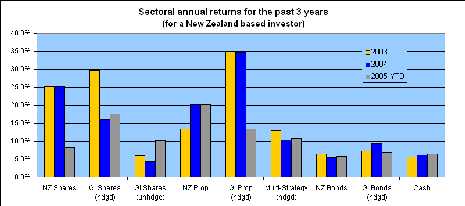

Returns in 2005 have played out in relatively orthodox fashion with hedged global equities and global properties the "star" sectors although all sectors, except NZ bonds, outperformed the high cash rates available in New Zealand. So yet again a balanced approach paid dividends, reinforcing the difficulty of trying to “time” markets and switch optimally between them.

Tyndall's hedge fund return was again respectable, while the impact of the strong kiwi dollar is shown in the 7% difference between a fully hedged and unhedged investor for global equities. The strong kiwi is a direct result of the high interest rates we currently have and not on the immediate economic growth outlook for New Zealand, which appears to be poor.

A surprise in 2005 has been the continued strong run from the global property sector (up 18%), after rising by over 30% in each of 2003 and 2004. NZ shares struggled in the latter half of 2005, after some stellar years, as the down turn in consumer and business confidence, combined with high interest rates and the strong kiwi dollar started to impact on investor sentiment. However, the return from NZ shares is still positive for the year to date which is better than the flat to negative return I expected this time last year.

So what is the outlook for 2006? I must start by emphasising how difficult it is to pick investment market turning points. Rather, this outlook is more about how long-term trends might unfold in 2006, rather than providing a short-term market timing strategy.

Global Outlook

After a lot of discussion on this issue last year investor focus on the US "twin deficits" seems to have waned. This is despite the US trade gap being US$66 billion for the 2005 September month, compared with US$39 billion for the entire 1992 year! The trade gap issue therefore remains significant and at some stage a savage adjustment (a significantly weaker US dollar and markedly higher US interest rates) might eventuate. However, more likely through 2006 is a US dollar being buoyed by relatively high US interest rates and a reasonable US domestic economy. This combination would actually worsen the already high balance of payments deficit but it would still be well short of New Zealand’s massive current account deficit (as a percentage of GDP).

The US sharemarket could "muddle" along in 2006 with 13% being the consensus S&P 500 earnings growth expected, according to Thomson Financial. However, this figure probably has more downside than upside risk potential with higher short term interest rates not helping.

The good news for 2006 may be a continuation of the formative recoveries in Japan and Germany, which should contribute more to global growth than at any time over the past decade. As highlighted in my commentary this time last year, Japan had the potential to bounce and I would expect this momentum to continue. In Germany business confidence and investment seems to be returning, which is traditionally a key driver for their economy. All of the above (plus China!) suggests a reasonable global growth profile in 2006 and therefore that oil prices will probably stay north of US$50 a barrel in 2006.

Potential threats to my relatively benign global outlook are a loss of confidence in the US dollar, bird flu spreading amongst humans, oil prices going through the roof and/or a global house price correction. While these are all potentially significant – some are probably mutually exclusive and the likelihood of these factors derailing markets in 2006 appears relatively low.

Domestic Outlook

In last month's commentary I was bearish on the prospects for the New Zealand economy and this view has not changed – particularly given the renewed strength this month in the kiwi dollar.

If Alan Bollard continues with his threat of continued tightening into 2006 I do not see any way around a recession for New Zealand. While this could set up this country for a period of more sustained growth longer term, it may not make 2006 one for domestic equity investors to remember with any fondness! Conversely investors in domestic bonds are more likely to see this sector out perform cash after a tough 2005 year.

For the kiwi dollar it may well be a year of two halves with the first half boosted by very high domestic rates. In contrast at some stage in the second half there may be a swift reversal. This is due to the prospect (if not the actuality) of an easing in monetary policy, a possible 10% balance of payments deficit (!!) and significant EuroKiwi and Uridashi maturities. Moreover, on a Purchasing Power Parity basis the kiwi is significantly over valued against most major currencies and so is vulnerable to a swift downwards adjustment if confidence in it wanes.

The reasonable global outlook, relatively poor domestic outlook and the possibility of a significantly lower kiwi dollar by this time next year all point to the necessity for any balanced portfolio to have some currency exposure. This is typically through having all or some of the global equities sector unhedged. We feel most balanced fund investors should have currency exposure of at least 20% and that it is important to ensure this is the case going into 2006.

Finally, I'd like to wish all our readers a very happy Christmas. This year has turned out to be an excellent year in terms of returns and may 2006 be a prosperous year for all investors.

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

No comments yet

FSF - Mainland Group sale unconditional

TRU - Study Confirms Superiority of TruScreen+hr-HPV co-testing

March 9th Morning Report

March 6th Morning Report

PEB - First Triage Plus Tests Ordered from Townsville

March 5th Morning Report

Devon Funds Morning Note - 04 March 2026

Genesis Energy announces opening of Rights Offer

March 4th Morning Report

Comvita appoints Andrea Wilkins as Chief Marketing Officer