IRG

|

Friday 9th August 2013 |

Text too small? |

Ryman Healthcare limited (RYM) is the provider of Retirement Living options for New Zealanders over the age of 70. The company provides a range of retirement living and care options, including Independent Townhouses & Apartments, Serviced Apartments and a Care Centre providing Rest home, Hospital & Dementia level care.

RYM was established in Christchurch in 1984. It was listed in June 1999 followed a public offering of 30 million shares at a price of $1.35. In January 2007 the company implemented a 5:1 share split.

At the time of writing this report, RYM has Retirement Villages from Auckland to Invercargill, providing homes for over 6,000 residents and employing over 3,500 staff. RYM also unveiled plans to open its first village in Melbourne, Australia in 2014.

*Based on price as of 9th Aug, 2013

Performance

Ryman Healthcare reported an underlying profit of just over $100.2 million for the year ended 31 March 2013 - a new record for the company and up 19% on last year. Unrealised valuation gains lifted the reported profit after tax to $137 million.

Operating cash flows grew 31% to $222 million; Shareholders’ funds have nearly doubled since 2008 to $734m, and Ryman have a bank debt to equity ratio of only 31%.

The Company built 517 new retirement village units and 226 new aged care rooms during the year, achieving the target of opening 700 units and beds in New Zealand, and commenced construction of Ryman’s first village in Melbourne. Ryman also managed to increase the sale of occupation rights by 26.28%.

The management announced that on the back of good results the board decided to increase the annual dividend by 19% to 10 cents per share, with the remaining profits being retained for investment in new villages both in New Zealand and Australia.

Outlook

The company purchased new sites in the Auckland suburb of Birkenhead along with Petone in Lower Hutt and informed about more land acquisitions in the year ahead, as they increase New Zealand landbank from three to four years’ stock.

The management said that their plan remains to achieve a medium term target of 15% growth in underlying profits, which will be driven by both the ongoing new build programme and from the completed villages. The company remains committed to building in New Zealand, to meet the growing need for both new aged care facilities and new housing for older people. Ryman will continue to target a build rate in New Zealand of 700 units and beds per annum, and believes that this as sustainable over the long term.

Ryman indicated that the company’s intention remains to increase dividends in line with the growth in underlying profits, and to maintain a conservatively geared balance sheet.

Demographic Indicator

The demographic growth projected by Statistics NZ for New Zealand between 2016 and 2036 gives the indication of high demand for new aged care and retirement units in the future. Similarly the numbers in Australia predicts the same outcome for the future. The opportunity in Victoria, just a state by itself, is larger than the whole NZ combined. Ryman expects to be in a position to roll out in Victoria by early 2014. Recruitment and development of existing staff, investing in better system is already up and running to accommodate the next phase of Ryman’s growth in Australia. The company’s aim is to match the build rate of New Zealand with that of Australia, which will definitely take some time to achieve.

Summary

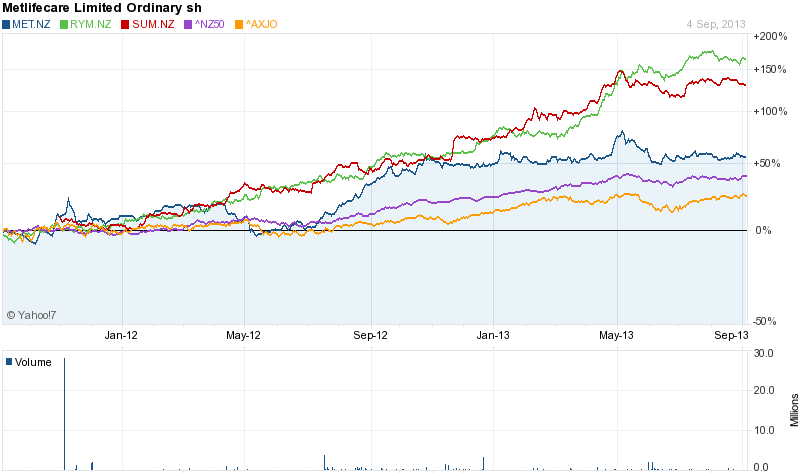

Ryman has been one of the outstanding performers of the New Zealand Stock market. It is one of the very few companies in NZX which have given strong results year after year and subsequently the share price has grown by 178% since 2011. The strong results can be attributed to the increase in aged population in New Zealand, Ryman’s flexible business model and some good decisions by the management. In fact the quality of Ryman’s management and the success of the company were recognized as Ryman received the prestigious Deloitte/Management magazine “Company of the Year” award.

Ryman has seen many years of unprecedented growth and the results of Ryman speaks for how well managed the company is. However, with the listing of competitor Summerset, investors now have alternative option for investing in the aged care sector. Also, Ryman’s first venture into Australia is subject to whether the company will have the similar success across the ditch.

Ryman shares increased by 91.24% in one year and is rated to “outperform” the market by analyst consensus as compiled by Reuters.

Overall, Ryman is a good company and will suit long term investors looking for growth in share price and an annual increase in dividends.

Comprehensive Company Analysis

The report consists of Business Description, Highlights, Industry overview and Competitive Positioning, Financial Analysis, Management & substantial investor overview, Investment Risks, Market consensus and complete with information on Historical 5 years Income, Balance Sheet and Cash Flow statements.

Ryman (RYM) Preview $12.99 (incl GST) ![]() (18 pages)

(18 pages)

Ryman's dip a buying opportunity as Australian expansion looms, First NZ says

Ryman says first-quarter trading ahead of year earlier, meets company target

Ryman boosts FY profit 13 percent as fee income jumps, portfolio value climbs

Ryman Healthcare first-half profit rises 15 percent

Ryman's 1st Qtr ahead of last year; 28th village in Petone

Ryman Healthcare

Ryman may seek ASX listing as shares reach record high, profits rise

Ryman shares reach record high as profits rise

Ryman posts record FY profit, beats guidance, on strong demand for units

Ryman posts 15% gain in first-half earnings on sales growth, affirms FY guidance