|

Tuesday 16th April 2024 |

Text too small? |

15 April 2024

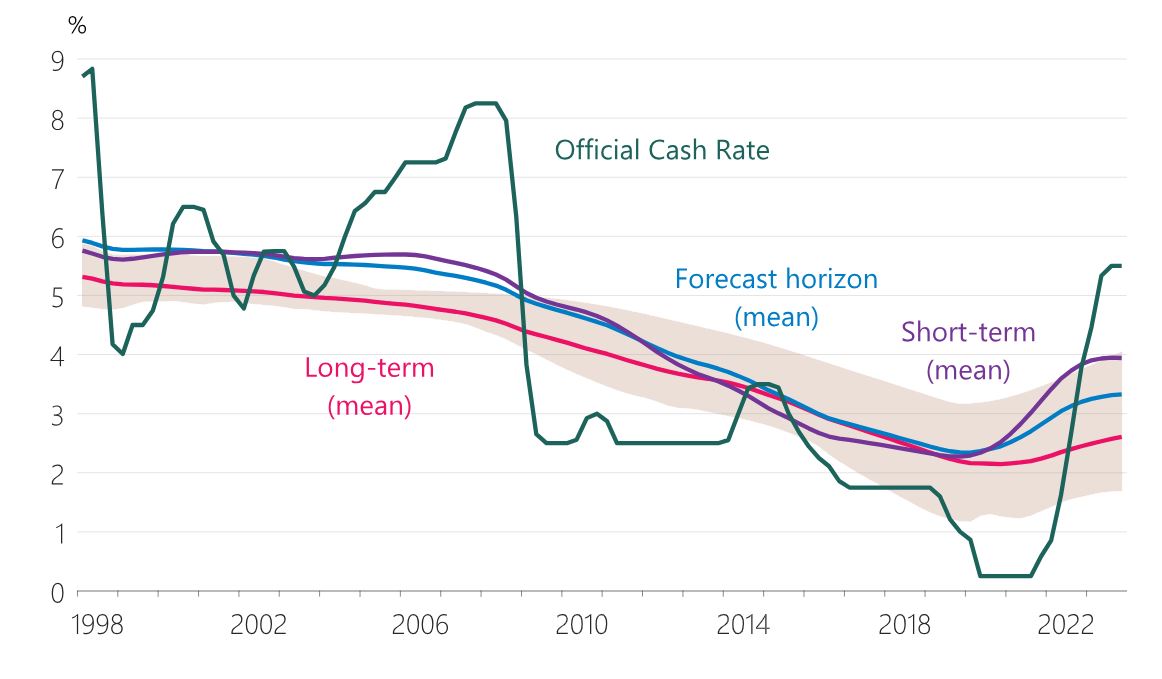

Due to New Zealanders’ high inflation expectations, the Official Cash Rate (OCR) would currently need to be about 3.9 percent to neither tap the brakes nor push on the accelerator of the economy, the Reserve Bank’s new Bulletin article shows. The current OCR – at 5.5 percent – is reducing capacity pressures and inflation in New Zealand.

This Bulletin article explains how we construct, use, and think about indicators for the neutral interest rate (NIR) at Te Pūtea Matua - the Reserve Bank of New Zealand (RBNZ).

When an investor considers their return on an investment, they are not merely interested in how many dollars they will receive in the future, but also how many goods and services they can purchase with those dollars. Therefore, their real rate of return can be calculated by subtracting expected future inflation from the nominal interest rate they invested at.

Likewise, it is the real NIR – the nominal NIR adjusted for inflation expectations – that matters for spending and investment decisions. However, the OCR is in nominal terms. So, to assess the stance of monetary policy, we need to adjust the real NIR for expected future inflation - from the short term, out to 10 years – to get an estimate of the nominal NIR.

Currently, with elevated inflation expectations, the “neutral” OCR is around 3.9 percent – our average short-term nominal NIR. This compares with the actual OCR of 5.5 per cent, which is therefore clearly contractionary.

As inflation expectations continue to decline, a lower OCR would be considered a “neutral” rate. For example, our average of 5 different real NIR estimates adjusted to an average long-term nominal NIR suggest that an OCR of 2.5 percent would be neutral.

The OCR (green line) is reducing inflation in New Zealand.

Figure 4: The nominal NIR estimates over different horizons

No comments yet

VSL - Date for 1H FY26 results announcement

January 28th Morning Report

IKE - Webinar Notification IKE Q3 FY26 Performance Update

VHP - Preliminary unaudited portfolio valuations 31 December 2025

PCT - Precinct Investment Partnership to acquire ASB North Wharf

SKC - FY26 Half Year Result Teleconference Details

January 22nd Morning Report

TGG - FY 2025 Earnings Guidance Update

Meridian Energy monthly operating report for December 2025

January 21st Morning Report