|

Friday 24th May 2013 |

Text too small? |

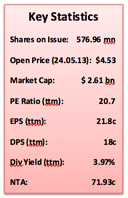

SKYCITY Entertainment Group Limited [SKC.NZX]: SKYCITY Entertainment Group Limited (SKYCITY) operates in the gaming/entertainment, hotel and convention, hospitality, recreation, and tourism sectors. The Company's operating segments include SKYCITY Auckland, SKYCITY Adelaide, SKYCITY Darwin and International business. SKYCITY Auckland includes casino operations, hotels and convention, food and beverage, car parking and Sky Tower and a number of other related activities. The Company's interest includes SKYCITY Hamilton, SKYCITY Queenstown Casino.

Performance

SKYCITY reported that for the period of six months ended 31 December 2012:

New Dividend Policy

SKYCITY has announced a new dividend policy which sees an increase in the dividend to a minimum of 20 cps per annum and not less than 80% of annual Normalised NPAT, subject to maintaining the company’s investment grade credit rating and giving priority to the funding of strategic projects. This increases the payout ratio which under their previous policy was set between 60-70% of annual Normalised NPAT. SKYCITY declared an interim dividend of 10 cents per share in accordance with the new policy which was up 11.1% from nine cents in 1H12.

The Convention Centre Deal

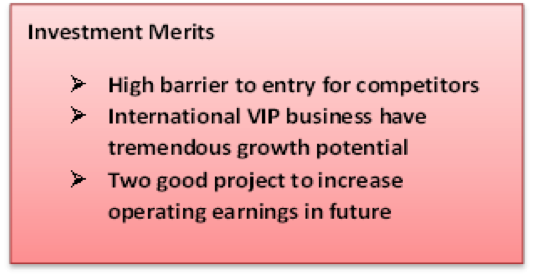

SKYCITY signed a Heads of Agreement with the New Zealand Government to design, build and operate the New Zealand International Convention Centre (NZICC). The total cost of NZICC including capitalized interest will be around NZD 400 to NZD450 million. The New Zealand government has offered regulatory concessions to Sky City’s Auckland casino in exchange for committing significant investments in building NZICC. Some of the regulatory concessions are as follows:

NZICC is perceived to boost NZ’s image as a business destination for international delegates, which in turn would have a beneficial impact on the tourism industry.

Adelaide Expansion

After reaching an agreement with the South Australian government, SKYCITY agreed to spend AUD 300 million (NZD 375 million) to expand the Adelaide casino. The expansion would change the Adelaide casino to an entertainment complex with a new and much improved gaming offering. The expansion of the Adelaide casino includes the construction of a 6-star boutique hotel, celebrity and signature restaurants, new car park facilities and creation of international VIP gaming suites and salons similar to the Horizon VIP suite in Auckland.

SKYCITY has also taken full control of Queenstown Casino for NZD 5 million. On 20th May, 2013 SKYCITY announced that they have agreed to buy the Wharf Casino in Queenstown for $5 million subject to regulatory approval from the Commerce Commission and the Gambling Commission. SKYCITY sees Queenstown as an area of significant potential for continued tourism development and are also part of a consortium that is the preferred group to build the Queenstown Convention Centre.

Summary

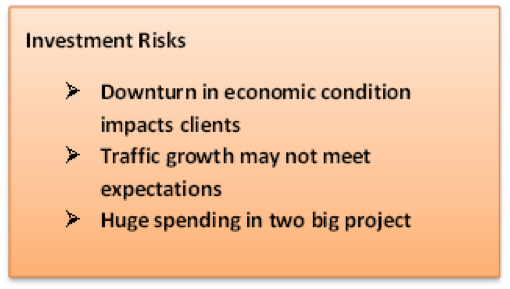

SKYCITY has been one of the most well-known organizations of New Zealand and with its iconic Sky Tower is easily one of the most recognized brand names for New Zealand overseas. SKYCITY also features in the TOP 10 companies in the New Zealand stock exchange. As discussed earlier SKYCITY has managed to secure some good acquisitions and with the extension of Auckland Casino license till 2048 they have successfully managed to reduce the risk of significant decrease in future operating earnings. It is also worthwhile to note that two big institutional investors Lazard Asset Management Pacific Co and BlackRock Investment Management (Australia) Limited have increased their holding in SKYCITY to 5.16% and 5.01% since April, 2013. This can be seen as a positive feature as institutional investors with high expertise may analyze SKYCITY as a good opportunity. SKYCITY does have risks involved by spending a substantial amount of money in development of NZICC and the Adelaide Casino. If the expected traffic growth is not achieved it will take the company a long time to recover the investment. However, both NZ and Australian Government expect tourism to grow particularly from Asia where most of SKYCITY’s high value players come from. It can be assumed that the Government will implement policies to attract tourism which will benefit SKYCITY. The share price has increased by 25.93% in the last one year and is rated BUY as reported by analyst recommendation compiled by Reuters. In conclusion SKYCITY seems to have an exciting future and may suit long-term investors who look for companies with growth opportunities.

Please note a full report on SKYCITY is available on request.

To discuss your options, to BUY or SELL shares or discuss about any other investments contact us on 0800 474 669 or email info@irg.co.nz

No comments yet

SkyCity's Queenstown growth ambitions face test with convention centre decision tomorrow

SkyCity buys TVNZ land for $10.6 mln, broadcaster to put cash into upgrading main building

SkyCity shares fall as results show struggle to squeeze growth out of Auckland

SkyCity FY profit falls 8 percent on flat Auckland result, one-off 2012 benefits

FMA recorded Allen's role in SkyCity talks as potential conflict of interest

South Australia approves ‘game changing’ SkyCity casino licence, allowing A$300M investment

Government roped in FMA chair Simon Allen to help close SkyCity deal, papers show

SkyCity cleared to buy Queenstown's Wharf Casino

NZ govt, SkyCity take another 5 days on $402M convention deal

NZ government, SkyCity extend deadline for deal on $402M convention centre