IRG

|

Tuesday 8th October 2013 |

Text too small? |

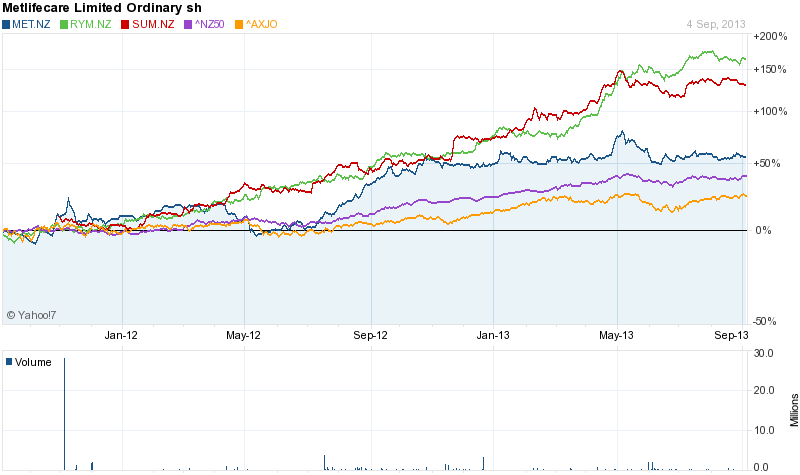

Metlifecare (MET.NZ) is New Zealand's second-largest listed retirement village operator and developer. Metlifecare has 23 villages (Ryman: 25) scattered over Northland, Auckland, Hamilton, Bay of Plenty and Lower North Island. The company was listed on the NZ Stock Exchange in July 1994 after a public issue of 15 million shares at 85c. On 23 July 2012, Metlifecare completed the merger with Vision Senior living (VSL) and Private Life Care Holdings Limited (PLC) adding eight villages and thereby boosting its profits for the year ending 30th June, 2013. Metlifecare also have plans to list on the Australian Stock Exchange (ASX).

Performance

Metlifecare Limited for the year ended 30th June 2013 reported Net Profit after Tax of $120.3 million, representing a significant turnaround from last year’s loss of $141.65 million. The net profit figure included a one-off gain on acquisitions of $63.6 million and an increase in the fair value of investment properties of $59.1 million. The company delivered net operating cash flows (excluding interest and merger costs) of $74.2 million. This figure exceeded the guidance provided in June 2012 in connection with the merger with Vision Senior Living and Private Life Care Holdings by 22%.

Sales activity was strong with 113 sales and 424 resales over the year compared to 36 sales and 294 resales in 2012, generating $199.1 million in gross cash flows. The increase in this figure is due to the addition of 8 more villages from acquisition which contributed to this number.

The directors announced an interim dividend of 1 cps which was paid in April 2013 and confirmed a final dividend of 2 cps will be paid on 17 October 2013. That brings the total dividend for the 2013 financial year to 3 cps, within the range noted in the June 2012 prospectus.

Outlook

MET focus for the coming years would be to further integrate the merged business from its previous acquisition. After the completion of Forest Lake Gardens village in Hamilton the company will concentrate its efforts on developing the news sites in Auckland’s North Shore. MET has commenced work on Stage 3 of The Poynton village in Takapuna, with a further 55 units to be built this year and a further 62 units planned in Stage 4. Plans are underway for two other North Shore villages, 4.4 hectare site in Unsworth Heights with capacity to build 310 units and 61 care beds and a new village in Glenfield, comprising 96 apartments and a 36 bed care facility. The company’s outlook for future development is to have a targeted sustainable development rate of 200+ units per annum by 2015.

Analysis

The company’s portfolio grew by 46% to 4,195 units and care beds over the twelve month period. The company is targeting a sustainable build rate of 200+ units and care beds by 2015 and has a current land bank of 827 units and 173 care beds. If MET is able to achieve the building rate the portfolio will grow by 4.76% per annum. Continuum of care will be an important growth area for MET who are looking to build on their in-home care offer and specialist care facilities in the existing villages as well as in the new developments.

Demand for the stock may be driven by increasing number of fund managers investing in healthcare service sector.

The area of concern for Metlifecare from our side is that it is highly exposed to the property prices and with a booming NZ housing market which is believed to be highly overvalued , a downturn will affect the company.

No comments yet

Contact Energy 2026 Half Year Results Presentation

February 2nd Morning Report

VHP - Half year results announcement date and webcast details

Devon Funds Morning Note - 30 January 2026

AIA - Auckland Airport new board appointment

General Capital (GEN:NZ) Subsidiary General Finance Update

January 30th Morning Report

January 29th Morning Report

VSL - Date for 1H FY26 results announcement

January 28th Morning Report