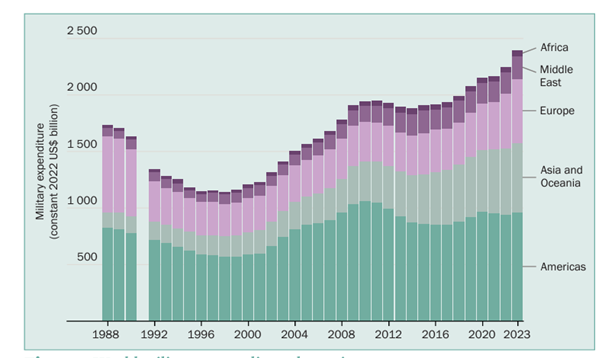

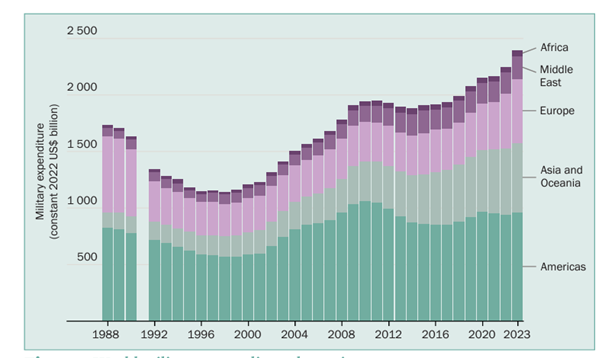

Global

The US indices pushed higher on Friday, with the S&P500 reaching its highest point since March 2022 as the non-farm payrolls report and a key consumer survey painted an encouraging picture of the US economy. Job creation and consumer confidence have held up well, at the same time that inflation is cooling. To use a well-worn financial markets cliché, this points to a Goldilocks outcome for the world’s largest economy, with the Fed wrapping up its rate tightening program. Officials are expected to leave rates on hold this week, and there will be much interest in what Jerome Powell has to say. It is a big week for central bank meetings, with the Bank of England and ECB also set to meet and expected to leave rates alone amid falling rates of inflation.

The S&P500, Nasdaq and Dow Jones were all up around 0.4% on Friday. The Dow and the broader S&P500 have now completed six winning weeks, which is the longest stretch since 2019. Bond yields have moderated, and the soft-landing scenario (with the avoidance of a steep downturn) has gone from a “hopeful” one to an outcome that seems increasingly likely. US CPI numbers are due prior to this week’s FOMC meeting, while retail sales will come after it is underway.

The non-farm payrolls report showed an unexpected drop in the unemployment rate to 3.7% in November, form 3.9% the previous month. The world’s largest economy created 199,000 jobs during the month, ahead of estimates for around 190,000, and up on the 150,000 jobs added in October. Job growth was dominated by healthcare and social services, which added more than 93,000 jobs, while there were around 49,000 roles created by government and 40,000 in leisure. The return of workers from the picket line in the auto sector and Hollywood also boosted net hires.

Monthly US job creation

Significantly, despite a strong employment market, average hourly earnings, rose in line with expectations, increasing by 0.4% for the month and 4% from a year ago. Pay growth is trending lower, while the participation rate at its highest-level post pandemic at 62.8%.

Also painting a resilient picture of the economy, was the University of Michigan survey which showed an index of consumer sentiment rising to 69.4, the highest since July, and well above estimates for 62.4. There was also good news on inflation, with the one-year outlook plummeting to 3.1%, down from 4.5% in November. The five-year outlook moved to 2.8% from 3.2%. Increasing levels of consumer optimism are encouraging, given spend here accounts for around two thirds of the economy. The data points are something of a ‘home run’ for investors with falling rates of inflation likely to set the scene for rate cuts at some point next year, against the backdrop of an economy which has weather a sustained period of rate tightening somewhat better than expected.

While not market related, hitting a home run of sorts as well over the weekend was Major League baseball player Shohei Ohtani. The Japanese baseball player has signed a ten-year contract with the LA Dodgers said to be worth US$700 million, which would make it the largest individual sports deal in the world (step aside Christiano Ronaldo). Ohtani is something of a freak in the sport, being a front-line pitcher and also a designated hitter. Having seen him hit a home run (playing for the Angels) at a packed Dodgers Stadium, and almost have the perfect game a few months ago, there is certainly something very special about him, and he is clearly a huge drawcard for fans.

Stock wise it was fairly quiet on Friday. Paramount share rallied 12% on reports that National Amusements, which owns the majority of the media giant’s voting shares, was being targeted in a takeover. Lululemon rallied 4% to a record high on the back of upbeat quarterly numbers from the yoga-pants manufacturer, and despite a cautious outlook for the holiday season from management.

Energy stocks were firmer as oil rallied over 2% on Friday, but still has its seventh straight week of losses as record production and demand concerns weigh on prices. Investors are also sceptical about the ability of OPEC+ to follow through on output cuts. There was meanwhile some big news in the pharma sector as the FDA approved the first “gene-editing” treatment to be marketed in the country. Casgevy uses Nobel Prize-winning technology CRISPR to treat sickle cell disease, a blood disorder that affects about 100,000 Americans. The one-time treatment is though out of the reach of most, costing US$2.2 million per patient.

Across the Atlantic, the indices were buoyant with FTSE100 gaining 0.5% while the STOXX50 surged 1.1%. The final estimate of Germany's consumer price index confirmed that inflation fell to its lowest in 29 months in November. CPI rose by 3.2% year-on-year last month, down from 3.8% in October, after prices fell by 0.4% during the month. This was the fifth consecutive month of falling annual inflation, with falling energy prices accounting for a large part of the slowdown, while price pressures on food have also eased.

Inflation is also falling in Asia. China’s CPI dropped 0.5% both from a month and a year earlier. This is the fastest decline in in three years. Perhaps not such a Goldilocks outcome for China, with inflation having been too cold rather than too hot. More stimulus needed. Meanwhile in Japan real wages fell for the 19th straight month in October, down 2.3% year-on-year, but better than the revised 2.9% fall seen in September. This may increase the reluctance of the Bank of Japan to move away from negative interest rates. The Nikkei fell 1.7% while the CSI300 in China rose 0.2%.

Comments from our readers

No comments yet

Add your comment:

Related News:

January 15th Morning Report

January 14th Morning Report

WIN - Winton Announces Timing of its Interim Results for FY26

FBU - Fletcher Building Quarterly Volume Report for Q2 FY26

January 13th Morning Report

RAK - Rakon Receipt of Takeover Notice

January 12th Morning Report

GEN - Resignation of Corporate Counsel and Company Secretary

January 9th Morning Report

VSL - Confirmation of MD/CEO and Board changes

Significantly, despite a strong employment market, average hourly earnings, rose in line with expectations, increasing by 0.4% for the month and 4% from a year ago. Pay growth is trending lower, while the participation rate at its highest-level post pandemic at 62.8%.

Significantly, despite a strong employment market, average hourly earnings, rose in line with expectations, increasing by 0.4% for the month and 4% from a year ago. Pay growth is trending lower, while the participation rate at its highest-level post pandemic at 62.8%.