By Anthony Quirk

|

Saturday 9th September 2006 |

Text too small? |

Hard landing – still not most likely scenario

The most likely scenario of a moderate fall in global growth, led by easing GDP growth in the United States (US) and China, still remains intact. The US economy grew by a healthy annualised 2.9% in the 2006 second quarter. The Chinese economy is slowing with interest rates having been deliberately raised for both lending and financial institutions. However, its growth still seems explosive by western standards, probably 8-10% in 2006!

The likelihood, however, of the less probable global “hard landing” scenario has increased recently. The OECD leading indicator is decreasing with some recent lower economic growth forecasts for Japan and Germany reinforcing this. In the US while corporate balance sheets are strong, North American business confidence has weakened significantly over the past few months. Moreover, US consumer confidence has fallen to a nine-month low. The impact of higher petrol prices and interest rates (mortgage defaults have jumped up) and more subdued employment growth seems to be having an impact.

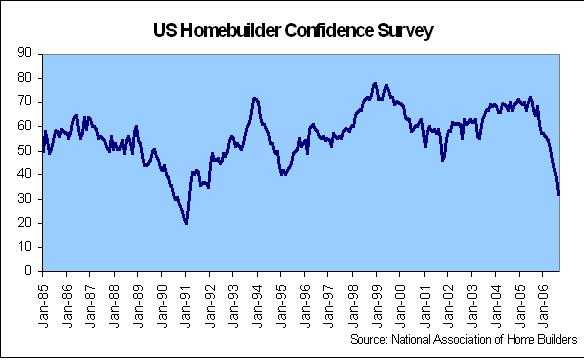

To add to this a developing risk is the US residential housing market, which is experiencing a significant fall. All indicators are down, including existing home sales (down eight straight months), existing home prices, new home sales, housing permits and inventory of unsold homes. As a result homebuilder sentiment is at fifteen-year lows.

The downturn is right through the US with big inventory build-ups of unsold houses from the East to the West Coast. In fact, this may be the first time in the post-war era that the US has seen a year on year decline in house prices nationwide. If this fall gains more momentum then it will further hit business and consumer confidence, net worth and consumption.

So we may now be seeing the bursting of a US residential housing bubble. The following quote from the Chairman of luxury homebuilder Toll Brothers reinforces this possibility. He recently stated that the current US housing slowdown “is the first downturn in the forty years since we entered the business that was not precipitated by high interest rates, a weak economy, job losses or other macro-economic factors”. He was highlighting that this downturn is more about speculative excesses in the market, resulting in a big over supply of houses. As we know from experience the reversal of excesses in any market can get ugly!

Such an outcome would cause angst for the Fed on whether it needs to ease rates earlier than it would like, to stop a hard landing developing. Or it could take a hard line approach and decide that a housing downturn is a necessary part of taking excess inflationary expectations out of the US economy (and at the same time helping fix its current account imbalances). However, it could then find it has a tiger by the tail as the wealth effect (and impact on consumer confidence) of a housing downturn is usually much more pronounced than an equity market fall.

Given this background and a slight easing in oil prices the probability of the US Federal Reserve (Fed) ceasing its tightening cycle has increased. The market odds (through Fed funds futures) of the Fed increasing rates at their next meeting in September are now about 10%, with a lowering predicted chance of a rate hike by year-end.

NZ economy vulnerable to a housing downturn

The rising concerns about the potential for the US housing sector to fall off a cliff doesn’t seem to have parallels (yet?) New Zealand (NZ). While house prices have not fallen year on year in NZ the rate of growth is definitely slowing. Our country is extremely vulnerable to a housing downturn equivalent to what is happening in the US as housing makes up such a large proportion of household net wealth here. Unfortunately various factors, including tax policy, have resulted in most New Zealanders having a relatively undiversified investment portfolio, with residential housing dominating. A recent Treasury paper confirms housing makes up 74% of New Zealanders’ total assets – not a diversified portfolio! This would make any material drop in housing sentiment and prices potentially very damaging for this country’s economy.

Even without this influence NZ households are already having to cope with increasing claims on their income from petrol prices, interest rates, local Council rates, etc. Given this environment, retail spending is slowing as well and actually shrank 0.5% in real terms for the June quarter. As expected in a downturn discretionary items are being impacted most with sales of cars, furniture, hardware and appliances worst hit. Completing the picture, consumer confidence also fell in August.

In turn business confidence is also being knocked with a sharp decline in how businesses feel about their own prospects. According to Goldman Sachs JB Were such a sharp decline to a low level has in the past been consistent with recession or weak economic growth. They say that this business confidence data is consistent with NZ September quarter GDP being basically flat. ,p> While the downturn in domestic sentiment is not that surprising the hope for an export-led recovery was hurt in August by a steady climb in the Kiwi dollar. It was up 4-9% against the major currencies for the month as our yields are still very attractive globally, while the US market starting to factor in an end to Fed rate rises is hurting the US dollar.

The bounce in the kiwi dollar is not what the Government, Reserve Bank (RBNZ) or sharemarket wants to see! When the market gets a sense that the RBNZ is going to ease rates (probably some time next year) then we believe there is significant downside risk for the Kiwi dollar from current levels. However, until then our attractive yields may keep the Kiwi higher for longer than most thought would be the case.

This means a squeeze for many companies, particularly in the manufacturing sector, from a combination of a weakening domestic demand, higher input costs from strong commodity prices and a stronger Kiwi dollar. This was illustrated in the latest result round where the outlook from several NZ based companies was cautious. An obvious example was the comment from the Chairman of Fisher & Paykel Appliances who feels his company is facing the toughest trading period since the 1973-74 oil shock!

This has contributed to the recent sell-off of the NZ equity market (down 8% from its peak in early April). The result is that, year-to-date, the NZX50 Gross Index has the worst return of any developed market, after it was also near the bottom in 2005. Once again this illustrates the power of diversification as offshore markets have markedly out performed, even if the drop in the Kiwi over the past year is ignored (and much more so if the currency fall is allowed for).

As First NZ Capital points out the NZ sharemarket seems to go through periods of over and under performance against global sharemarkets, with the previous under performance period being for six years between 1994 and 2000. Looking at various valuation measures the NZ market does not look cheap and so one wonders if we are about to go through another such cycle after the stellar returns from NZ shares in the first half of this decade. A significant housing downturn here would contribute to this occurring.

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

No comments yet

Opinion: Sorry Feltex saga has damaged reputations and confidence

Opinion: Commission investigation into Plus SMS will test credibility

Opinion: Government wants better co-ordination between regions

Opinion: A flutter on Sky City shares may become more of a gamble

Opinion: Slowdown? What slowdown? Economic data tells two stories

Opinion: Electricity investment uncertainty after mixed messages

Market review: At the crossroads

Opinion: This will transform the economy won't it? Yeah right

Opinion: Sharemarket performance as bleak as the weather

Opinion: Outcry grows as council rates to rise above inflation for years