|

Tuesday 1st September 2015 |

Text too small? |

September 01, 2015

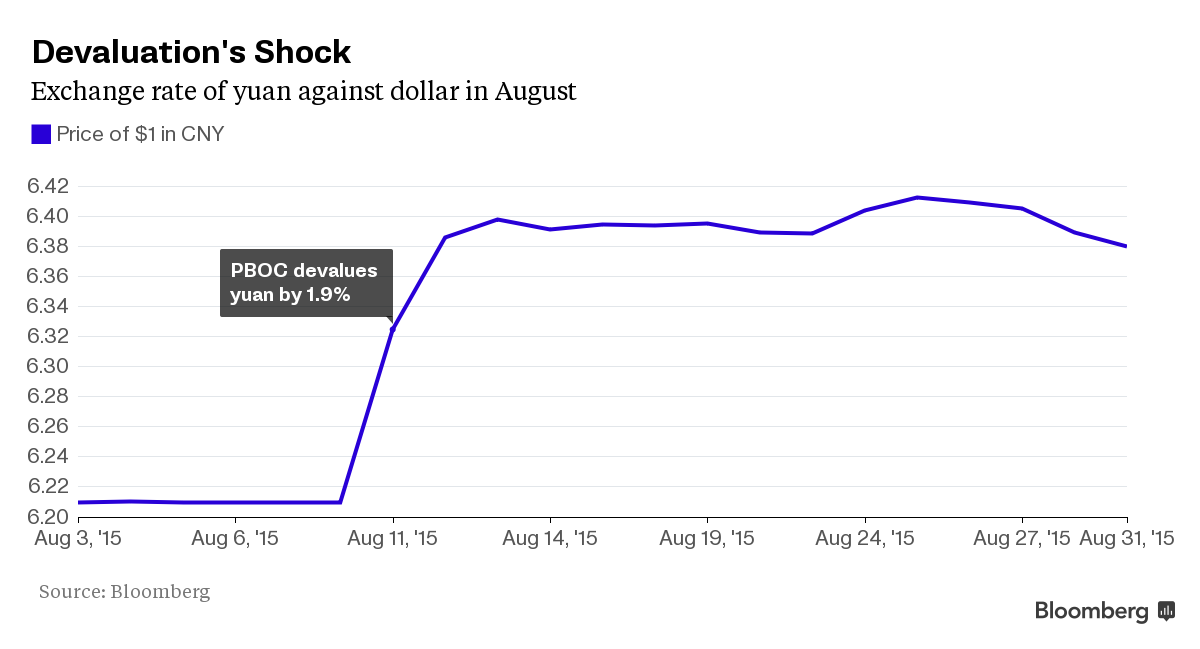

A series of technical policy changes overshadowed last month by a plunging stock market and the biggest yuan devaluation in two decades suggests China’s leaders are pressing on with reforms to open up the economy in the push to win reserve-currency status.

Overseas lenders were allowed to buy and sell the yuan onshore for direct investments; a currency reference rate will now be published five times a day in line with International Monetary Fund suggestions; and banks can set whatever deposit rate they like for terms longer than a year. Those incremental moves came on top of the attention-grabbing Aug. 11 move to give markets a bigger say in setting the yuan’s value.

The steps are part of an IMF prescription, including a 40-item list for capital-account opening, as the fund reviews whether to add the yuan to its Special Drawing Rights basket along with the dollar, euro, yen and pound.

The push is a “technocrats-versus-the-politicians” game, said Andrew Polk, an economist at the Conference Board in Beijing, who sees advocating for SDR status as a way for reform-minded officials to enact broader change.

“The technocrats have realized that internationalization of the renminbi can help them do the genuine task of marketizing they want to, and they can sell it to the political side by saying, ‘This is a very prestigious thing that we are doing,’ ” Polk said. Renminbi is the currency’s official name, and yuan is the unit.

People’s Bank of China Governor Zhou Xiaochuan has led the push for the yuan’s internationalization. Policy makers see SDR inclusion as a way to help improve the nation’s status in trade and finance and reduce dependence on the U.S. dollar.

Zhou said at the IMF’s April meeting that 35 of 40 items specified by the fund are already fully or partially convertible in China. The five remaining mainly involved individual cross-border investment and the issuance of shares and other financial instruments by nonresidents on domestic markets.

That list is shrinking. The start of the China-Hong Kong mutual fund recognition program, which allows mainland residents to invest in Hong Kong fund products, further opened the capital account, Wang Yungui, an official at the State Administration of Foreign Exchange, said at a June press briefing.

That’s in addition to a Hong Kong-Shanghai stock-market link, opening the bond market to foreign investors, and a proposed second stock connection between Hong Kong and Shenzhen.

“China’s agenda to open capital accounts will not change easily on some volatility or some external events,” PBOC Deputy Governor Yi Gang said at an Aug. 13 briefing, two days after the yuan devaluation. The government will achieve the goal in a steady and orderly way, “according to our own agenda.”

The PBOC has allowed overseas lenders classified as participating banks to buy and sell Chinese yuan onshore through clearing or agent banks to raise yuan for direct investment in China, two people familiar with the matter said last week, instead of permitting only trades under the current account. Offshore clearing banks and local agent banks can now trade yuan derivatives for foreign lenders.

The push to open financial markets is encountering resistance from some Chinese officials, according to researchers including China Construction Bank’s Zhang Tao and Xiao Lisheng of the Chinese Academy of Social Sciences.

Still, steps are being taken one-by-one to tick off prerequisites before the SDR review, which the IMF will decide as soon as late 2015. The reserve-currency aspiration helps push forward the financial reforms in the most difficult and uncharted areas, said Zhang, a researcher at CCB’s financial-market division.

Chinese government agencies have also brought financial- and economic-data releases in line with IMF data dissemination standards. The Finance Ministry and PBOC have both started releasing data more frequently, including for foreign-currency reserves.

“China will declare that it has achieved capital-account liberalization while retaining more restrictions on capital flows than other major economies,” Chen Long, an economist at Gavekal Dragonomics, wrote in a report. “That’s not a criticism: we think a headlong rush to a completely open capital account would be pointlessly risky.”

No comments yet

February 12th Morning Report

NZME 2025 Full Year Results Release Date

Turners Institutional Investor Day

February 10th Morning Report

PEB - Medicare Contractor Novitas Schedules Expert Panel

NZK Enters Into Wellboat Lease Agreement

Fonterra announces Mainland Group leadership change

OCA - Oceania announces Director changes as part of Board refresh

AIA - Analyst and media webcast for FY26 interim results

The Warehouse Group confirms leaner operating structure