|

Friday 17th July 2015 |

Text too small? |

www.bbc.com

Greek banks, which shut nearly three weeks ago, are due to reopen on Monday after the European Central Bank (ECB) raised the level of emergency funding available.

However, credit controls limiting cash withdrawals to €60 (£41) a day will only be eased gradually, officials say.

Earlier, eurozone ministers also agreed a €7bn (£5bn) bridging loan from an EU-wide fund to keep finances afloat.

The loan is expected to be confirmed on Friday by all EU member states.

The closure of Greece's banks has been one of the most visible signs of the country's financial crisis.

The country has debts of €320bn and is seeking its third international bailout. Last month it became the first developed country to fail to make a repayment to the IMF.

"From Monday, the services offered will be widened. All the banks everywhere will be open," deputy finance minister Dimitris Mardas told ERT television.

He said there might be a weekly limit on withdrawals, rather than a daily one.

"If someone doesn't want to take €60 on Monday and wants to take it on Tuesday, for instance, they can withdraw €120, or €180 on Wednesday," he said.

"This is a proposal we are processing and we think it's technically possible."

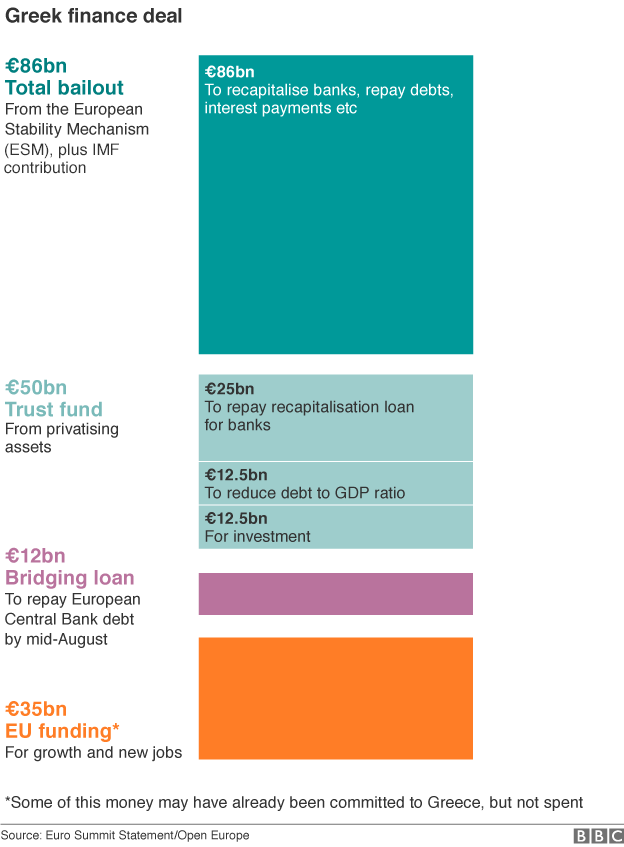

The announcements from the ECB and the Eurogroup came after Greek MPs passed tough reforms as part of a new bailout deal worth up to €86bn.

***

Analysis by Chris Morris, BBC Europe correspondent

The European institutions are now picking up the pace to make sure this rather chaotic show stays on the road.

There's more emergency funding for Greek banks from the ECB. And agreement on a €7bn bridging loan from the EFSM to get the Greek state through the next few days.

Greece needs to repay €4.2bn euros to the ECB on Monday, as well as making up all its missed payments to the IMF. In other words it needs to spend the €7bn almost as soon as it gets it.

Some creative financial engineering has ensured that short-term funding from the EFSM will get final approval tomorrow. And then attention will turn to negotiations on the three year bailout programme that Greece has applied for.

Those negotiations are likely to last for weeks, and plenty of things can still go wrong.

There's scepticism in Greece that the deal is too tough; scepticism elsewhere that it isn't tough enough.

Even today, the German Finance Minister Wolfgang Schaeuble has repeated his suggestion that maybe a "time-out" from the eurozone would be the best thing for Greece.

It is pretty unprecedented language. And it suggests that the battle to keep Greece in the eurozone is far from over.

***

ECB President Mario Draghi told a news conference that emergency funding - ELA - to Greek banks was being raised by €900m over one week.

"Things have changed now," he said. "We had a series of news with the approval of the bridge financing package, with the votes, various votes in various parliaments, which have now restored the conditions for a raise in ELA."

The €7bn bridging loan means Greece will be able to repay debts to the ECB and IMF on Monday.

It was agreed in a conference call on Thursday to tap the EU's EFSM emergency fund.

The move had angered some EU states who are not in the single currency, but on Thursday the UK said it had won an agreement to protect its contribution in the EFSM.

Chancellor of the Exchequer George Osborne said the concession would also apply to other non-eurozone states.

Greek Prime Minister Alexis Tsipras won the parliamentary vote in the early hours of Thursday by 229 votes to 64, but needed the support of opposition MPs to do so.

***

What happens next?

***

There were angry protests in the streets of Athens by many who believe Greece has conceded too much to its creditors to win the bailout.

Mr Tsipras's left-wing Syriza-led government is expected to survive, despite losing its majority after 38 Syriza MPs rejected the reforms.

He is expected to reshuffle his cabinet in the near future.

The vote in the early hours of Thursday approved:

By 22 July, Greece must also commit to a major overhaul of the civil justice system. It has to agree to more privatisation, to review collective bargaining and industrial action, and make market reforms, including of Sunday trading.

The vote paved the way for eurozone finance ministers to open detailed talks on the bailout and on Thursday they said they agreed "in principle" to start negotiations.

Some eurozone states need a mandate from their own parliaments for Greece to secure new funds and Germany's parliament is due to vote on the deal on Friday.

No comments yet

Skellerup achieves another record result

August 21st Morning Report

Me Today signals capital raise and provides trading update

Seeka Announces Interim Result and Updates Guidance

FBU - Fletcher Building announces FY25 Results

August 20th Morning Report

RUA - New Zealand grown products support Rua's global strategy

Devon Funds Morning Note - 19 August 2025

Seeka Announces 15 cent Dividend

MCY - Major renewable build advanced despite 10% earnings dip