|

Tuesday 28th July 2015 |

Text too small? |

By Victor Reklaitis

July 27, 2015

While you were sleeping, a major Chinese stock benchmark endured a beatdown not seen in more than eight years.

The Shanghai Composite SHCOMP, -8.48% closed 8.5% lower for its biggest one-day percentage tumble since February 2007, as investors worried about a slowdown in government buying and disappointing industrial data. In other words, Monday was the roughest day for Shanghai stocks since before the global financial crisis hit. The index now stands just 6% above its July 8 closing low, as shown in the chart below. That’s after briefly trading on Friday as much as 19% above that four-month low. The Shanghai Composite is also 28% below its multiyear closing high on June 12, which was then followed by a multiweek selloff.

Here are a few initial reactions to the rout in Shanghai:

Gloom in Beijing: “The declines must be especially dispiriting in Beijing, where officials probably felt they had finally gotten a grip on what many commentators said was impossible: controlling the stock market,” writes Alex Frangos in a Heard on the Street column for The Wall Street Journal.

But Beijing still tries to soothe: “Beijing came out assuring us AGAIN that it’s got this,” writes Shuli Ren in a blog post for Barron’s. “A recent research paper conducted by China’s Academy of Science was splashed all across Chinese media today. According to the Academy, as of the end of 2013, China’s net assets came in at 350 trillion yuan, ‘enough to accommodate 1.5 times a financial crisis.’”

More pain ahead? A UBS strategist has suggested that it still could get worse for Chinese investors, according to a tweet from CNBC:

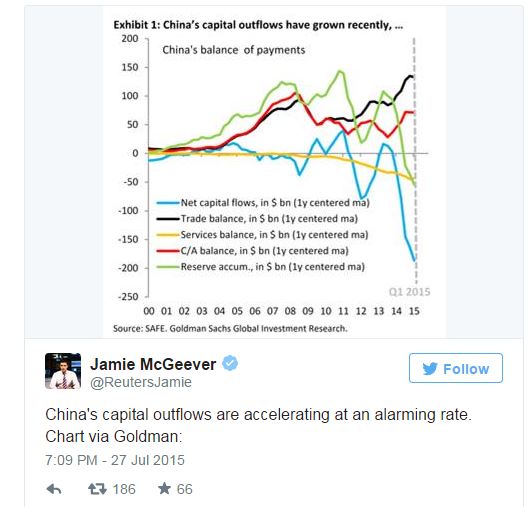

Money heading for the exits: China watchers are also looking beyond the Shanghai index and emphasizing other scary charts like the one below:

No comments yet

Skellerup achieves another record result

August 21st Morning Report

Me Today signals capital raise and provides trading update

Seeka Announces Interim Result and Updates Guidance

FBU - Fletcher Building announces FY25 Results

August 20th Morning Report

RUA - New Zealand grown products support Rua's global strategy

Devon Funds Morning Note - 19 August 2025

Seeka Announces 15 cent Dividend

MCY - Major renewable build advanced despite 10% earnings dip